Printed on February 19, 2021. EST READ TIME: four MIN

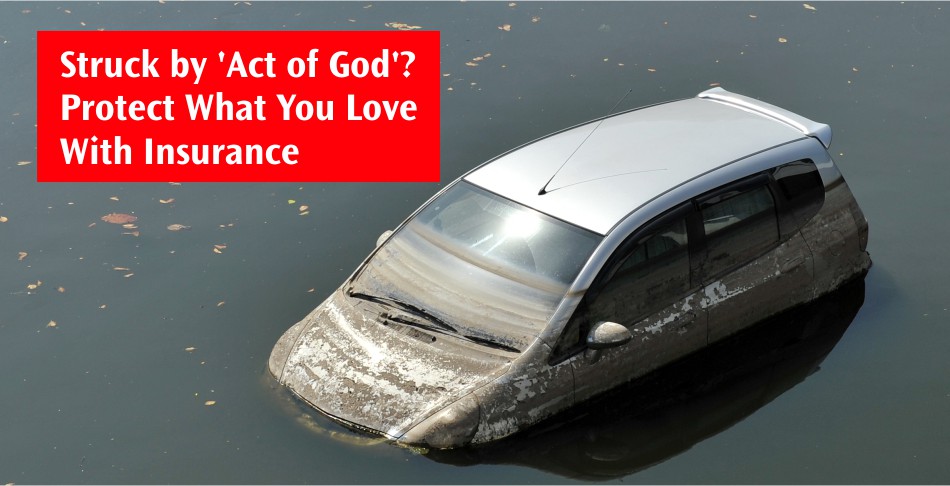

Pure disasters like landslides, floods, hurricanes, and earthquakes, also referred to as Acts of God, can wreak havoc on residents, and take away an enormous chunk of 1’s property inside minutes. Not solely are such disasters troublesome to foretell, but in addition after they strike — relying upon their severity — one can train little or no management to guard oneself.

However there are methods to arrange for pure calamities financially. Insurance coverage cowl is one such means. When pure calamities strike, choosing complete motor insurance coverage and residential insurance coverage insurance policies come in useful if one needs to deal with losses. Except there’s something that’s particularly excluded from these insurance policies, loss from pure disasters can be lined up until the sum insured. Therefore, these covers show to be important for individuals who care to guard their property from unexpected calamities.

Motor Insurance coverage

However how does insurance coverage defend your automobile throughout a pure catastrophe? Let’s say you had opted for Complete Motor Insurance coverage coverage as you reside in a flood-prone space. Within the occasion of a flood, your automobile will possible be closely broken, if not unusable. Via your coverage, now you can avail protection as much as the sum that was insured to you, which can be utilized to restore your present automobile or purchase a brand new one. The sum insured can be given to you as soon as the situation of your automobile is assessed and it’s verified that the damages incurred are lined by your motor insurance coverage coverage. Two-wheeler insurance policy additionally work the identical manner.

Moreover, motor insurance coverage for different pure disasters additionally works to guard one’s automobile in the identical method. When you determine your disaster-prone geography, choosing HDFC ERGO’s complete motor insurance coverage offers safety to your automobile from damages like fires, earthquakes, cyclones, floods, vandalism, and theft. At the moment’s motor insurance policy – like Single Yr Complete coverage for automobiles and Multi-Yr Complete for two-wheelers or Covers for brand new automobiles or two-wheelers – include a number of add-on covers for an enhanced protection. One such being the zero depreciation protection, whereby your automobile’s worth may drop every year, however the quantity insured to you stays unchanged.

Dwelling Insurance coverage

With regards to insuring a house, you may discover the concept pointless. It is very important take into account how shortly a pure catastrophe that impacts your private home can immediately drain your financial savings. Dwelling insurance coverage is effective at a time like this. A house insurance coverage plan typically protects policyholders from any structural injury that was induced to their properties due to pure disasters. Thus, in case of an earthquake, a flood, or another type of unintended injury, your private home insurer covers your bills for renovation and restore.

The Backside Line

A complete motor insurance coverage and residential insurance coverage coverage offers you widespread safety towards a slew of pure disasters that would strike. Relying upon your geographical location, it’s possible you’ll be liable to experiencing sure varieties of pure disasters greater than others. Therefore, it’s smart to go for protection towards these probably damaging occasions, particularly if one is a home-owner or a automobile proprietor. Defending your self with a complete automobile insurance coverage coverage and residential insurance coverage coverage cannot solely support in overlaying the losses incurred when disasters strike however can even ease the sensation of uncertainty that comes these occasions.

Disclaimer: The above info is for illustrative functions solely. For extra particulars, please seek advice from coverage wordings and prospectus earlier than concluding the gross sales.

This weblog has been written by:

S. Gopala Krishnan | Motor Insurance coverage Skilled | 40+ years of expertise in insurance coverage business

A veteran within the insurance coverage business, S. Gopala Krishnan is a reputation to reckon with within the area of reinsurance. He has headed the Reinsurance division and has wealthy expertise in different fields of motor insurance coverage. He likes to share his opinion on newest subjects within the insurance coverage business and the way he may help folks in safeguarding their property utilizing insurance coverage merchandise.

Few Different Articles:

Automotive insurance coverage for cover towards pure calamities

The significance of house insurance coverage towards pure calamities

All it’s essential find out about engine safety cowl in automobile insurance coverage