Generally, the first study that pops up in your mind when you enter a sanitarium is how important lighter your portmanteau will be when you leave. In a world of advanced technologies, the field of drugs is one of the frontrunners, and with technology comes cost. It isn’t uncommon for a routine check-up bill to run into the thousands and a longer stay at the sanitarium will always set you back by many lakhs. At least when you’re in a sanitarium for treatment, a dependable and comprehensive health insurance policy might just save your day, and your portmanteau.

What’s Health Insurance?

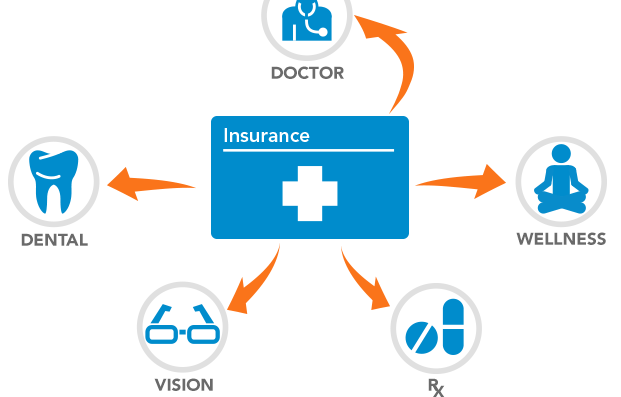

When you choose a health insurance policy, your medical charges will be taken care of by your policy provider and in return, you’re needed to pay a periodic figure, called‘ ultraexpensive’which can also be paid in yearly installments. Depending on which policy you conclude for and who provides it, health insurance protects your portmanteau by covering treatment charges, hospitalization charges, ambulance costs, laboratory costs, and other affiliated charges. Some programs indeed cover compensation for misplaced income.

Why should you have a health insurance policy?

Just to give you a perspective about the growing need for health insurance content in India, according to the report by WHO, 68 of Indian health charges are Out Of the Pocket (OOP) which is intimidating. Also, only 18 of civic and 14 of the pastoral population in India are covered under health insurance. Purchasing health insurance at a youthful age is a prudent decision since decorations are a lot lower. It’s worth noting that numerous programs don’t cover-existing ails and ails being within 30 days of purchase of the policy, except those incurred by an accident.

Still, or are allowing about getting one, then’s a list of reasons which will make you apprehensive of the significance of health insurance, If you don’t have a health insurance policy yet.

Cashless treatment All major health insurance providers have numerous popular hospitals under their network, called network hospitals. Whenever you enter one of these hospitals for treatment, all you have to do is flash your health insurance card (or indeed just your insurance policy number), and everything will be taken care of after filling out many forms if required. However, still, you’ll have to pay for the treatment and claim payment latterly, If you choose a non-network sanitarium. So, cashless treatment is one of the biggest benefits of a health insurance policy, as only many of us can arrange large totalities at short notice for treatment purposes.

Rising Medical Costs and Health diseases According to statistics by India against cancer, the number of cancer cases registered every time is in 2022. The cancer rate has nearly doubled in the last 26 times in India. Along with this, other life-changing conditions like tuberculosis and diabetes are also on the rise. Add this to the ever-adding cost of drug and treatment and you’ll have to look no further as to why health insurance is a must-have.

Free Medical check-up & Fresh Benefits Numerous insurance companies give free medical check-ups every time as a complimentary benefit for their guests (although, some companies give free check-ups only if you haven’t claimed insurance once many times). You’ll also be eligible for a No Claim Perk (NCB), that is, the sum ensured quantum of your policy increases by a certain quantum handed you haven’t claimed insurance, except as an inpatient, during the policy period. In addition to this, ambulance charges, pre, and post-hospitalization charges are some of the other benefits offered by insurance companies.

Duty benefits Under section 80D of the Income Tax Act, you can mileage duty benefits for the decorations paid towards your health insurance policy. For individualities under the age of 60, a total deduction of ₹ can be claimed if the parents of the existent are below the age of 60 (₹ for Tone, Partner and dependent children and ₹ for parents) and ₹ if parents are above the age of 60 (₹ for Tone, Partner and dependent children and ₹ for parents). Still, also an aggregate of ₹ 1, 00, If both the individual and parents are further than 60.

Peace of mind Above everything differently, having a well-planned insurance policy covering your reverse is a great relief especially when there’s an intimidating increase in life-changing conditions in once many decades. It can save you and your family in times of medical extremities and overall, in your overpacked diurnal schedule, you’ll have one lower thing to worry about.

Now that we understand and appreciate the significance of health insurance, let’s have a look at what you need to consider while choosing one.

What to consider while looking for a health insurance plan

As advised ahead, it’s better to buy a health insurance policy at a youthful age. Decorations tend to increase with age, as do the pitfalls of health issues.

Look for a policy that covers terminal ails. These are the bones that tend to drain our finances the most, so it makes no sense to not include them in the covered list.

Don’t choose a policy with a higher-payment clause. Co-payment is the portion of the bill you have to pay from your fund when a claim arises. The rest is paid by the insurance company, as per the terms of the policy.

Choose the applicable riders/ add-on features along with your health insurance policy, which can add to the overall content net of the policy.

Types of Health Insurance

Indemnity Plan, In this case, a certain quantum of the sanitarium charges is to be paid by you, and the insurance provider will take care of the rest of the bill. You can choose which croaker to visit and the insurance company doesn’t get to decide the sanitarium or corroborate whether the visit was necessary. But this autonomy is only to a certain extent. Concurrence from the insurance company is still needed in case of extremities, for admission into an exigency room if you aren’tincapacitated. However, you’ll have to pay the whole bill out of your fund first also claim for payment, If you choose the Indemnity plan.

Exclusive Provider Organization (EPO) Members of an EPO plan will be needed to use a defined network of croakers and a Primary Care Croaker (PCP) who’ll give referrals to network specialists for treatments. Still, this condition isn’t applicable for extremities. You’ll be responsible for a small quantum of payment too.

Point of Service (POS) Just like in EPO visage, POS also provides a PCP to choose from the network providers. In similar cases, you’ll admit advanced content. Still, if you choose an anon-network sanitarium, you may be subject to a deductible (co-payment) and the content will be less too. Also, you may have to pay up frontal and also claim a payment.

Add-ons for Health insurance

Top-ups A top-up plan combined with an introductory insurance plan will give you sufficient content with affordable decorations. A top-up plan is a fresh content that kicks in when your health expenditure crosses the quantum covered by your introductory insurance plan. While top-ups cover the expenditure of a single hospitalization, super top-up plans cover the charges of the entire time over a wide range of ails.

Riders By adding a rider to your introductory health insurance plan, you can expand your insurance content by customizing it as per your demand for a fresh charge. There are numerous riders to choose from-Critical illness rider, motherliness rider, particular accident rider.,

. Defined benefit plans Introductory health insurance plans generally don’t cover-hospitalization charges like food, trip charges of your attendant, drug charges, and treatment charges for ails which didn’t beget the hospitalization when you were rehabilitated, etc. Defined benefit plans will come to your deliverance and give you an assured-defined benefit anyhow of your charges.

What your health insurance policy won’t cover

Ails as a result of substance abuse If it’s apparent that your illness is a result of inordinate smoking, alcohol consumption, and other lawless substances, your claim will be rejected.

Treatment at home If the case isn’t rehabilitated, the claim will be void. Although some policy providers may cover treatment at home, the quantum that can be claimed will be less.

Certain Medicines and specifics Not all medicines used to treat critical ails like cancer are covered by the insurers. Some chemotherapy medicines which are taken orally aren’t covered, medicines falling under immunotherapy are generally not covered too. Some programs don’t cover the injections administeredintra-artery and Intra-lesional.

Resident croaker’s charges If the occupant croaker’s charges are mentioned independently in the bill, it’ll not be covered. Still, if it’s included in the room charges, it may be covered depending on the policy provider.

New or Advanced treatments Unproven or experimental treatments like robotic surgery aren’t a part of policy content. Stem cell curatives are also generally not covered.

Non-medical charges Charges related to Toiletries and other convenience particulars are barred from policy content. For the list of all particulars barred from content, you can relate the indirect no. IRDA/ HLT/ CIR/ 036/02/2013 released by IRDAI.

Pre-existing ails Generally pre being ails are moreover not covered at each, or not eligible for a claim until a certain cinch-in period is decided by the insurance company.